Find Your Way To Debt Freedom

Our vision & promise is to offer a safe place for people in debt to find help and support. Our services come without jargon. We are open, honest and helpful.

Could An IVA Help Me?

For those who qualify, an IVA allows for affordable repayments and typically writes off a significant amount of debt. Learn more

An IVA may not be suitable in all circumstances. Fees apply. Your credit rating may be affected

Learn more about managing debt and receiving free debt advice at moneyhelper.org.uk.

Get Started Here

Find the right solution for you

Every day we help people find their most suitable debt solution.

Bankruptcy – is it right for me?

We’ll help you decide if bankruptcy is your best option and explain any implications.

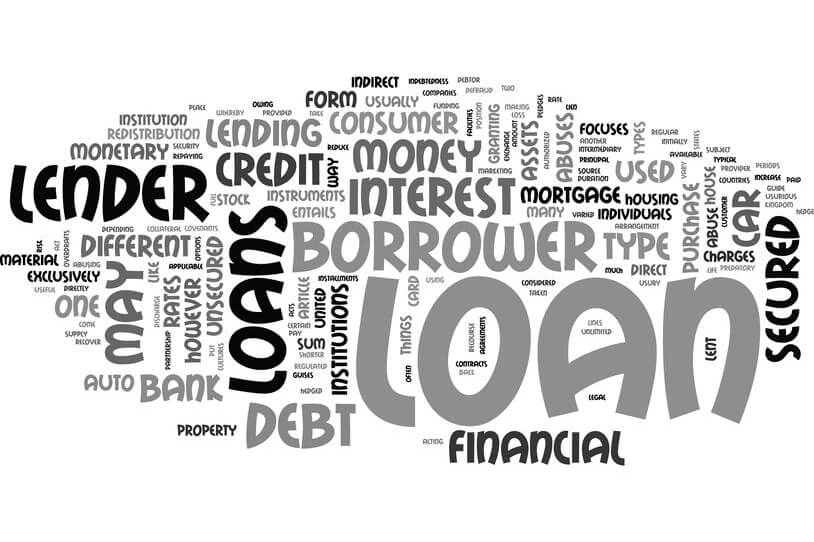

Debt Management

An informal arrangement with your creditors which allows you to repay debts at an affordable level.

Breathing Space

Breathing Space is a new debt option that gives you temporary protection from the creditors you owe money to if you’re struggling with debts.

Negotiated Agreement

Simply communicating to your creditors can be positive step towards solving problem debts.

Debt Consolidation

A consolidation loan is credit taken out to pay off existing debts, putting them into one monthly commitment.

Remortgage & Equity Release

A remortage debt solution is taking multiple unsecured debts and adding them to debt secured on a property.

Debt Solution Example

Savings possible from a typical IVA

Before: applicant currently pays £380/m towards debts, which are:

| Overdraft | £2,500 |

| Personal Loan(s) | £7,000 |

| Credit Card(s) | £5,000 |

| Other includable debts | £6,000 |

| Total Current Debts | £20,500 |

|---|---|

| Further interest & charges while repaying these debts over several years could be say... | £4,000+ |

| Cost to Clear Debts | £24,500+ |

After: applicant can afford £130/m towards debts, then:-

Current payments

*IVA payments

| IVA payments | £130 * 60 months |

| Cost To Clear Debts | £7,800 |

|---|---|

| Total Saving | £16,700 |

| Repaid % | 32% |

| *Payment levels depend on affordability of the individual applicant and are subject to creditor acceptance. | |

Advice You Can Trust.

Read what people are saying about Debt Guardians

Get Started Today

Give us 15 mins - We'll help get your life back on track

2 -Your Consultation

A friendly & experienced advisor from Debt Guardians will contact you to discuss your circumstances.

3 - Your Solution

Benefit from keeping your hands on more of your money.

Debt Guardians Advice Centre

Tips and information about dealing with debts

See what people are saying about us

We have many testimonials on independent customer review site trustpilot.com.

10 Steps To Take Control Of Your Debts.

Facing up to your financial situation is an important first step.

Resources Directory

Organisations offering support to those in need and authoritative information resources.